In the year 2024, the finance world remains rapidly changing and very dynamic. However, one thing is certain—the use of cryptocurrencies and blockchain technology is on the rise and their influence in the finance ecosystem has been very significant. Digital assets that were once perceived as irrelevant and “doomed to fail” in the finance world are now drawing the attention of established and renowned financial institutions.

One of the ways by which financial institutions have been able to penetrate the cryptocurrency market is through the adoption of white label crypto exchanges. A white label crypto exchange is a pre-built digital asset exchange platform customized to fit the needs of a business (the financial institution in this case) and operated under the name and license of the business. Think of it as a simple pre-built crypto trading platform made for a financial institution with all the important features of a crypto platform and properly branded and customized to the institution’s brand, regulations, and target audience.

Contents

Why White Label Crypto Exchanges— Opportunities for Financial Institutions

It is important to learn why many financial institutions are choosing to partner up with white label crypto exchanges. Let’s discuss some of the opportunities or benefits that the adoption of white label crypto exchanges presents to financial institutions.

- Diversification of Revenue Streams: It is no news that cryptocurrencies are steadily becoming very relevant in the financial world. Crypto assets are a distinct asset class in the finance industry with distinct risk-return profiles. Financial institutions can integrate them into their system to improve risk diversification and even unlock new streams of revenue through exchange fees, wealth management services, custody services, and so on.

- Meeting Increasing Customer Demand: The demand for crypto in the general market, with retailers, and even institutional investors is at an all-time high. However, there is still the fear of fraud among these parties. Financial Institutions capitalize on that gap by offering a familiar and secure platform for their users. This will help them retain and expand service offerings for their customers.

- Strategic Partnerships and Collaborations: Most renowned white label providers have established collaborations with liquidity providers, custodians, and blockchain companies. Financial Institutions can leverage this to access a network of expertise and infrastructure they would not necessarily have access to.

Challenges for Financial Institutions

Despite the opportunities involved in financial institutions adopting white label crypto exchanges, a lot of challenges still exist for financial institutions in this situation. Some of them are:

- Regulatory challenges: The regulations around cryptocurrencies are constantly changing and evolving with varying levels of strictness across different jurisdictions. It is therefore quite challenging to navigate the unstable regulatory environment of crypto.

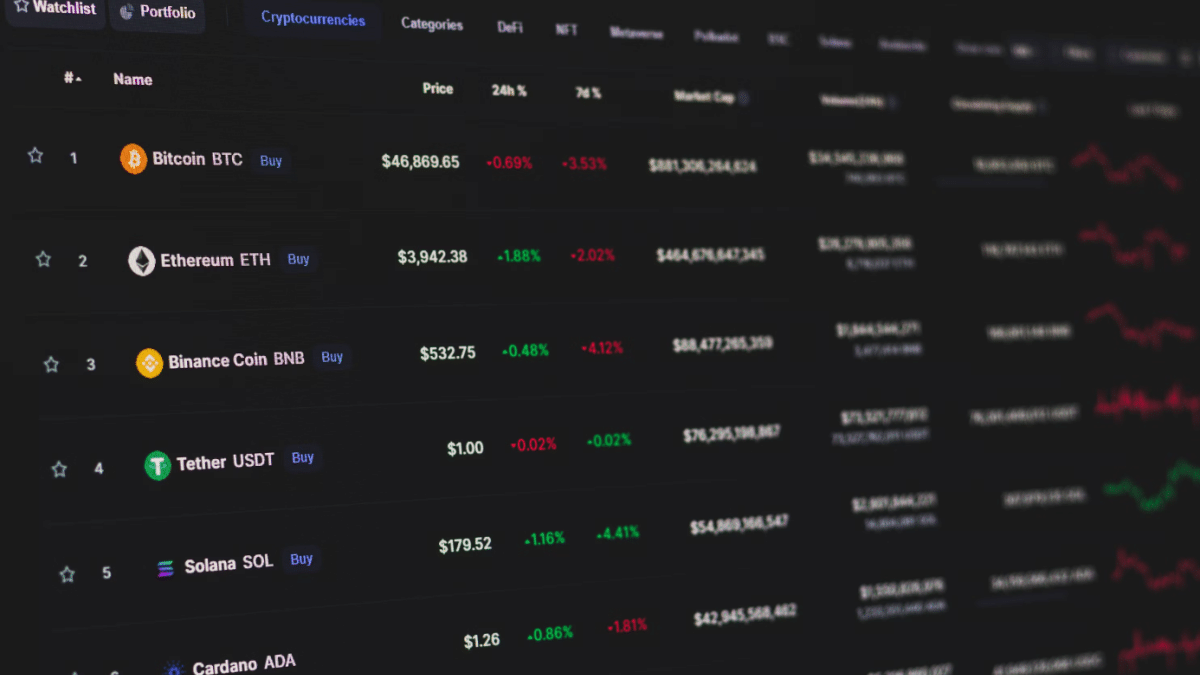

- Market Volatility: Cryptocurrencies are known to be very volatile assets. Their volatile nature can be very risky for financial institutions in terms of significant customer losses and reputational damage for these institutions.

- Security: Due to the nature of cryptocurrencies, they are prime targets for hackers. Financial institutions interested in adopting crypto exchanges must heavily invest in security features and take care of any vulnerabilities that are present in the system.

- Complex technology integration

- Competition

Frequently Asked Questions (FAQ)

- What are the challenges faced by Financial Institutions that adopt white label crypto solutions?

Some of the challenges faced by financial institutions that integrate white label crypto exchange solutions include regulatory challenges, integration with existing technology, and risk management, among others.

- Why are many Financial Institutions considering white label crypto exchanges?

Financial institutions are quickly adopting white label crypto exchanges for several reasons. Some of the popular reasons include diversification needs, faster launch time, meeting the needs of their customers, and so on.

- What strategies can financial institutions use to differentiate themselves from competitors?

Financial institutions willing to differentiate themselves from other competitors using white label exchanges can implement strategies such as niche differentiation, integration of advanced technology, and provision of robust educational resources for users.