Bridging loans have become a popular choice for covering short-term property investment costs. All bridging loans are bespoke agreements between the issuer and the applicant; though in most instances share several common features.

Examples of which include the following:

- Loans available starting from £50,000 with no upper limits

- A bridging loan can be arranged within a few working days

- Interest applies monthly at rates starting from just 0.5%

- Full loan balance to be repaid within 1 to 18 months

- Funds secured against assets of value, usually residential or commercial property

- Minimal additional borrowing costs and no early exit fees

- Can be used for any legal purpose whatsoever

- Open to applicants with poor credit or a history of bankruptcy

- No proof of income necessary and no deposit payable

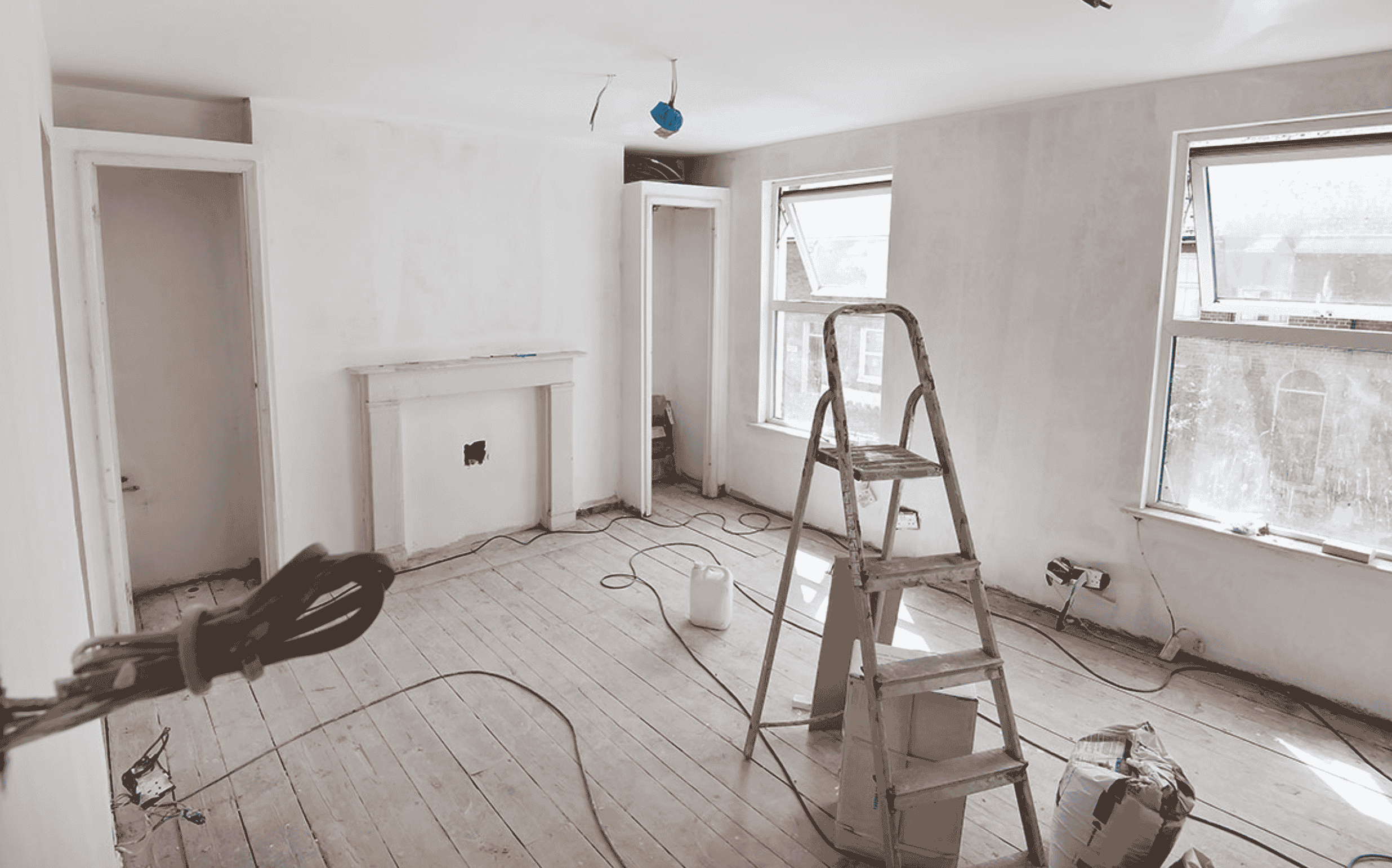

The short-term nature of a bridging loan makes it the ideal choice for investors looking to pick up homes at low prices, conduct improvements and sell them on at a profit.

But what happens when an investor makes the decision to hold onto their property longer-term? Is a bridging loan a viable facility for buying BTL properties, and what are the longer-term repayment options if so?

The Best of Both Worlds

Bridging finance is always issued as a strictly short-term facility. Irrespective of the type of bridging loan you take out, you’ll be expected to repay the balance in full within 1 to 18 months.

But this does not necessarily mean that bridging finance is unsuitable as a buy-to-let investment tool. For investors looking to purchase properties quickly and retain them long-term, refurb-to-let combines the best of both worlds.

Refurb-to-let is effectively two products in one, beginning with a bridging loan that works in the normal way.

A short-notice bridging loan is issued by the lender, enabling the investor to take advantage of a time-critical property purchase opportunity – perhaps at auction. The funds raised can be used to cover the full costs of the property purchase, and all subsequent renovations necessary to let it out to tenants.

The whole thing works in the same way as a conventional bridging loan, with interest accruing monthly at a rate of around 0.5%. The difference is that with refurb-to-let, the loan automatically transitions to a longer-term repayment facility at the end of the agreed term.

Rather than having to repay the loan in full, the outstanding balance is repaid with a longer-term loan – a buy-to-let mortgage, a commercial mortgage or a similar facility.

This subsequently provides the investor with the freedom to gradually repay their debt over the course of several years or decades. Refurb-to-let combines the fast-access flexibility of bridging finance with the affordability of a conventional mortgage, complete with low rates of interest and minimal associated borrowing costs.

Refurb-to-let is always more cost-effective than taking out two different loans with two separate providers. But as many bridging loan companies do not offer refurb-to-let products as standard, it is important to enlist independent broker support to ensure you target the right lenders.