It’s 2026, and let’s be honest: buying a home is stressful enough without the added headache of decoding complex mortgage math. If you tried shopping for a loan a few years ago, you probably remember the drill—fill out a “simple” form, hit enter, and immediately get bombarded by twenty different salespeople calling your phone. It was intrusive and overwhelming.

But the landscape has shifted. Today, comparing mortgage quotes isn’t just about plugging numbers into a static calculator. It’s about finding a strategy that fits your financial DNA. Whether you are a first-time homebuyer, a seasoned investor, or self-employed, the goal is clarity without the chaos. In this guide, I’ll walk you through how to compare quotes effectively using the latest tools, from traditional calculators to the new generation of AI Mortgage Agents.

Contents

What is a Mortgage Loan Quote?

Before we dive into the tools, we need to define what we are actually looking at. A “Mortgage Quote” is often misunderstood as just an interest rate, but as any industry veteran will tell you, that’s only the tip of the iceberg.

A true mortgage quote is a comprehensive estimate that includes the Interest Rate, the APR (Annual Percentage Rate), Closing Costs, Points (fees paid to lower the rate), and the Loan Term.

Here is the crucial part that many online tools miss: Accuracy depends on your specific profile. A generic “3.5% rate” advertisement is meaningless if it doesn’t account for your Credit Score (FICO), your Debt-to-Income (DTI) ratio, and your down payment.

- Interest Rate: The cost of borrowing the principal.

- APR: The real cost, including the rate plus broker fees and closing costs. This is the number you should use to compare lenders apple-to-apples.

If you are only comparing interest rates, you might be missing thousands of dollars in hidden fees. A legitimate quote reflects your eligibility, not just a marketing number.

How to Compare Mortgage Quotes Online?

So, where do you start? In 2026, we essentially have two categories of tools: the traditional Static Calculators (good for rough math) and the emerging AI Mortgage Agents (good for personalized matching and shopping). Let’s break down the top options.

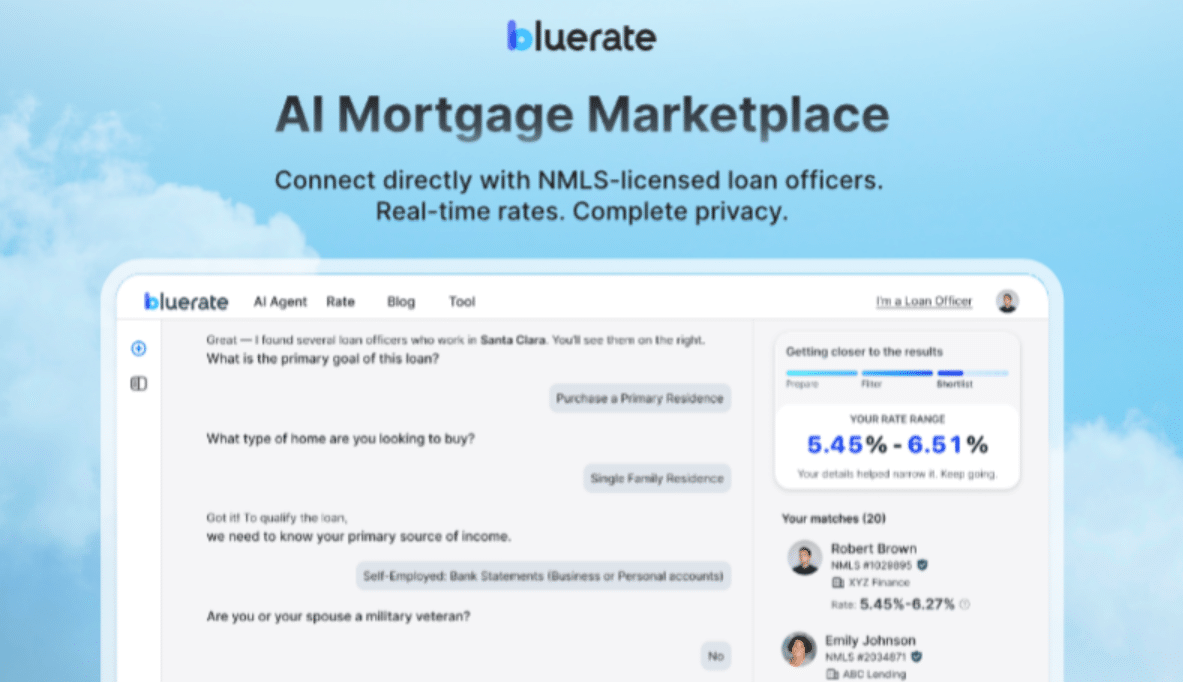

Bluerate AI Agent – The Smart Way to Compare

If you are looking for the most modern, comprehensive way to shop for a mortgage in 2026, Bluerate is currently leading the pack. Unlike the calculators I’ll mention later, Bluerate isn’t just a math tool. It’s a 24/7 AI Loan Officer Assistant developed by Zeitro.

My experience with Bluerate was fundamentally different because it felt like talking to a human expert, but without the sales pressure. Instead of filling out a static form, you chat with their AI Agent. It uses a “Prepare-Filter-Shortlist” process to understand your financial story—whether you are a standard W-2 employee, a self-employed freelancer needing a 1099 loan, or an investor looking for DSCR (Debt Service Coverage Ratio) options.

Why it stands out:

- Real-Time Precision: It connects directly to a Loan Origination System (LOS) and pulls live rates from over 100 lenders (including Conventional, FHA, VA, USDA, and Non-QM). This means the quote you see is based on live market data, not yesterday’s averages.

- Privacy First: This is a huge win. Bluerate is SOC 2 Type II certified and promises a “spam-free experience.” You can compare rates and get matched anonymously. Your data isn’t sold to aggressive telemarketers. You only connect with a Loan Officer when you decide to hit the “Contact” button.

- The Match Score: It doesn’t just give you a list of lenders. It uses a proprietary Match Score to pair you with NMLS-verified Loan Officers who specialize in your specific situation. For example, if you need a VA loan, it filters for experts in that field, not generalists.

- Speed: The AI can pre-qualify you up to 2.5x faster than traditional methods, helping you understand your purchasing power in minutes.

For anyone tired of the “apply and wait” game, Bluerate offers a refreshing, transparent, and highly accurate alternative.

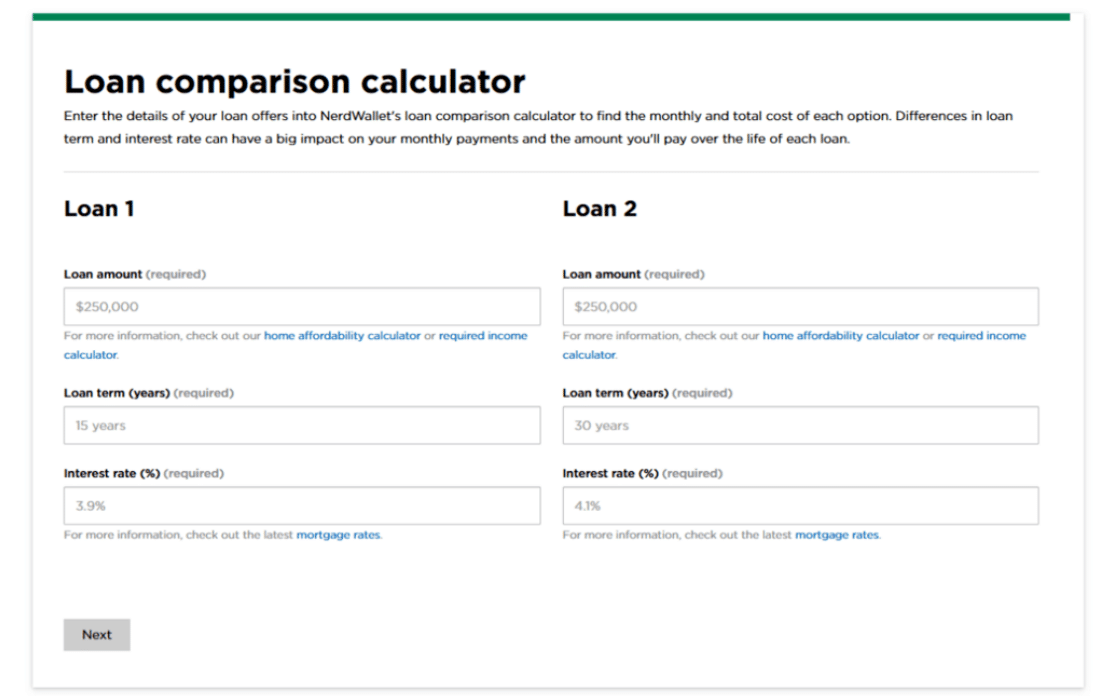

NerdWallet Loan Comparison Calculator

If you aren’t ready to chat with an AI and just want some “napkin math,” the NerdWallet Loan Comparison Calculator is a classic staple. It’s a straightforward, web-based tool designed for simplicity.

To use it, you simply input the Loan Amount, Loan Term (years), and Interest Rate (%) for two different loan scenarios. The calculator then instantly displays a side-by-side comparison of the Monthly Principal & Interest and the Total Interest Paid over the life of the loan.

Pros:

- It is incredibly fast and requires no login.

- Great for visualizing the long-term cost difference between a 15-year and a 30-year term.

Cons:

- Garbage In, Garbage Out: You have to manually guess the interest rate to input. If you enter 6.5% but your credit score only qualifies you for 7.2%, the results are useless.

- Lack of Depth: It doesn’t factor in your specific income, debts, or property taxes. It gives you a mathematical difference, but it cannot tell you if you actually qualify for the loan.

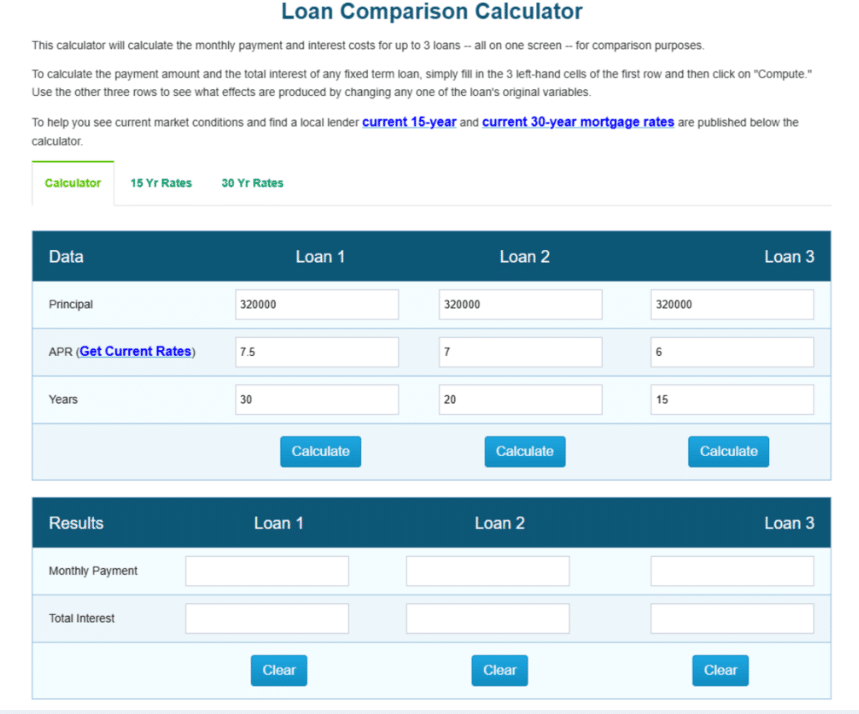

Mortgage Loan Comparison Calculator

Moving up a step in complexity, we have the calculator from MortgageCalculator.org. This tool is similar to NerdWallet’s but offers a bit more granularity for the analytical user.

Here, you input the Principal, APR, and Years (term). A distinct feature is its ability to pull Current Local Thirty-Year Mortgage Rates based on your location, which adds a layer of realism that basic calculators lack. It allows you to compare up to three different loan scenarios simultaneously.

Pros:

- Comparing three loans at once is helpful if you are shopping multiple offers.

- It breaks down the “Total Interest” clearly, showing you exactly how much the bank earns from you.

Cons:

- User Experience: The interface can feel a bit cluttered and dated compared to modern AI apps.

- Still Static: Like NerdWallet, it ignores your “Financial DNA.” It doesn’t know if you are self-employed or have a high DTI. It calculates the numbers you give it, even if those numbers are unrealistic for your borrowing profile.

CrossCountry Mortgage Comparison Calculator

Finally, let’s look at a lender-specific tool: the CrossCountry Mortgage Comparison Calculator. This tool is designed to give you a visual representation of your loan options.

You input the Loan Amount, Loan Term, Interest Rate, and notably, the Origination Fee. The output is a clean, easy-to-read bar chart that compares Total Interest, Total Closing Costs, and Total Principal.

Pros:

- Visual Clarity: The bar charts make it very easy to spot which loan is more expensive upfront versus long-term.

- Fee Inclusion: By asking for the Origination Fee, it forces you to think about closing costs, which is a critical part of a real quote.

Cons:

- Limited Scope: Since it is provided by a specific lender, it may not encourage you to shop the entire market.

- Missing Variables: Like the others, it lacks the ability to analyze credit scores, income stability, or liabilities. It’s a calculator, not an advisor.

Why Do You Need to Compare Mortgage Quotes?

You might be wondering, “Is it really worth the effort to compare all these numbers?” The short answer is: Absolutely.

A mortgage is likely the largest debt you will ever take on, and even a fraction of a percentage point matters.

- The Cost of Loyalty: Don’t just stick with your current bank out of habit. A difference of just 0.50% in interest on a $500,000 loan can save (or cost) you over $50,000 in interest over the life of the loan.

- Closing Costs Vary: Interest rates aren’t the only variable. Lender A might offer a lower rate but charge higher origination fees (APR). Comparing quotes allows you to see the true cost of the loan.

- Eligibility is Key: This is where AI tools shine. You need to compare not just costs, but guidelines. One lender might reject your application because of a strict DTI requirement, while a Non-QM specialist (found through a marketplace like Bluerate) might approve you based on cash flow. Comparing quotes is also about comparing who will actually lend to you.

Conclusion

The era of “blind mortgage shopping” is officially over. While traditional calculators like NerdWallet and MortgageCalculator.org are still useful for quick, rough estimates, they lack the personalization required for today’s complex financial landscape. They can do the math, but they can’t confirm if you qualify.

In 2026, leveraging technology like the Bluerate AI Agent changes the game. It combines the speed of AI with the trust of NMLS-verified professionals, allowing you to find the perfect rate and Loan Officer without sacrificing your privacy. Whether you are buying your first home or managing an investment portfolio, stop guessing with static numbers. I recommend starting a chat with Bluerate to get a real, data-driven look at your options—it’s free, private, and might just save you thousands.